Tech Explained: Here’s a simplified explanation of the latest technology update around Tech Explained: Agentic AI, Data Center Protests, Gemini hits 20% AI Share | Newsletters in Simple Termsand what it means for users..

Trends To Watch in Technology in 2026

As we kick off 2026, the tech landscape is buzzing with major developments across AI, infrastructure, and enterprise transformation. Here’s what the latest news this week is telling us about the likely shape of the industry as this year gets underway.

AI Takes Center Stage Again

No surprises here, as we covered recently, the AI boom is likely to continue full steam. However, it may enter a more pragmatic and less hype-filled stage this quarter as tech giants and startups try to convince users of its benefits and trustworthiness for consumer and enterprise use cases.

Agentic AI Goes Mainstream in 2026

The shift from AI assistants to autonomous agents is accelerating. Enterprises are embracing agentic AI systems for workflows, with applications spanning fraud detection, loan processing, and customer service. These systems are moving beyond simple task automation to handle complex, multi-step processes with minimal human intervention. However, challenges like low-quality data are impeding adoption, and cybersecurity investments are rising to counter AI-driven threats. Organizations are discovering that the success of agentic AI depends heavily on having clean, well-structured data foundations and robust security protocols.

The AI Infrastructure Boom & Backlash

The AI infrastructure surge continues with a 331% increase in construction spending since 2021, impacting $64 billion in projects. This massive buildout is transforming regional economies and creating thousands of jobs, but it’s not without controversy—142 activist groups across 24 states are protesting rising electricity costs, making data centers a mainstream political issue heading into the 2026 midterms. Communities are grappling with the trade-offs between economic development and the strain on local power grids, with some regions seeing electricity rates climb by double digits.

AI Market Share Shift

Gemini is reshaping AI website traffic, nearly capturing 20% share while ChatGPT has fallen below 70% from 87.2%. Over the past year, Gemini’s share has tripled to 18%. This dramatic shift reflects Google’s aggressive integration of AI across its product ecosystem and improved model performance, challenging OpenAI’s early dominance in the consumer AI space.

Major Deals & Investments

Mega Funding Rounds

SoftBank just completed its $40B investment in OpenAI, boosting its stake to 11% and supporting AI infrastructure ventures with Oracle. This represents one of the largest single investments in AI history and positions SoftBank as a major player in the AI infrastructure buildout. Other major 2025 funding rounds included Anthropic ($13B), xAI ($10B), and Databricks ($5B). These massive capital influxes underscore investor confidence in AI’s transformative potential across industries.

Strategic Acquisitions Are Back Underway Already

Nvidia is on an acquisition spree, acquiring the innovative “LPU” Language Processing Unit Chip manufacturer, Groq for $20 billion and in advanced talks to acquire Israeli AI startup AI21 Labs for up to $3 billion. These acquisitions strengthen Nvidia’s position in specialized AI hardware and complement its GPU dominance. Meanwhile, Meta is acquiring Chinese AI startup Manus which shot to fame with its Monica AI agent last year that changed the game in the travel sector and online shopping. It was snapped up for over $2B to enhance Meta’s AI solutions and strengthen its Asia Pacific presence, particularly in e-commerce applications.

Companies to Watch

Cloud & Infrastructure

-

CoreWeave and Lambda — These neoclouds are anticipated to seize $20B in revenue by offering specialized AI infrastructure as enterprises turn to private AI solutions. Their focus on GPU-optimized infrastructure and flexible deployment options is attracting companies seeking alternatives to traditional cloud providers for AI workloads.

-

Brookfield — Launching a cloud business to lease chips to AI developers as part of a $10B AI fund, operating data centers in France, Qatar, and Sweden. This marks a significant expansion for the infrastructure investment giant into the technology sector.

Chinese AI Innovation Continues

-

DeepSeek — The leading Chinese open-source large language model company will continue to challenge Western dominance in AI technology this year. Their models have demonstrated competitive performance while requiring fewer computational resources, making advanced AI more accessible globally.

-

Zhipu IPO — The Chinese large language model developer is set to raise HK$4.35B ($560M) through a share sale in Hong Kong, debuting January 8 with a market valuation of HK$51.16B. This IPO will be closely watched as a bellwether for AI valuations in Asian markets.

Neobank Fintech Innovators

-

Nubank — This neobank has rapidly expanded its customer base, marking significant growth in the fintech sector. Nubank’s focus on cross-border transactions and stablecoins positions it as a formidable player in the evolving financial landscape.

-

Klarna — Known for its innovative buy-now-pay-later solutions, Klarna is expanding its reach by integrating open finance systems. The company’s growth in the neobank sector highlights its adaptability and future potential in fintech.

Neuralink’s Breakthrough Tech Goes High Volume

Neuralink — Elon Musk just announced plans to start high-volume production of Neuralink’s brain-computer interface devices and to automate surgical procedures by 2026. The company aims to scale from experimental trials to treating thousands of patients with paralysis and neurological conditions. They face a range of competition emerging both in the US and China, with several startups racing to commercialize similar technologies.

xAI and Tesla

xAI has launched Grok Business and Grok Enterprise subscription tiers aimed at small businesses and larger organizations, providing access to advanced AI models for workplace tasks. Grok Business focuses on small-to-medium teams, while Grok Enterprise offers additional features like Custom SSO and advanced security controls. The company assures that proprietary enterprise data will not be used to train other AI models. xAI received a $200 million contract from the US government to modernize the Defense Department. The new tiers are designed to enhance collaboration and data security for enterprise customers.

The Information just predicted that Tesla will buy xAI in 2026. At this point it wouldn’t be surprising if it were the other way around. Elon Musk just announced xAI plans to open another collossus data center building and scale its compute to eclipse the entire global compute at current rates.

2026 Predictions & Trends

Enterprise Transformation

Firms will emphasize tech modernization to enhance operations and cut costs. Companies are moving from AI experiments to impactful business solutions, with leaders urged to solve specific problems quickly and involve users in design. The focus is shifting from “AI for AI’s sake” to targeted deployments that deliver measurable ROI. Organizations are learning that successful AI adoption requires not just technology investment, but cultural change and workforce reskilling.

Emerging Technologies, Smart Home Assistants, Predictive Markets

2026 will witness the rise of generative UI, smarter home assistants, and AI labs handling complex environments. Generative UI will enable interfaces that adapt dynamically to user needs and contexts, moving beyond static designs.

Predictive markets are emerging as mainstream tools for forecasting and decision-making, driving transformation in the fintech landscape. These markets leverage collective intelligence and AI to improve predictions about everything from business outcomes to geopolitical events, driving a significant transformation in the fintech landscape with improved accuracy and insights.

Cybersecurity Evolution

The focus will shift to AI-driven security platforms as attackers’ AI capabilities improve. Spending will increase on agentic security to overcome hiring issues, with AI replacing traditional tools and offering real-time security advice during coding and testing. Security teams are adopting AI agents that can autonomously detect, respond to, and remediate threats at machine speed, addressing the cybersecurity talent shortage while improving response times.

CES 2026 – The Key Event To Watch This Month

CES 2026 kicks off again on January 4 with major tech companies like Samsung, LG, NVIDIA, Intel, and AMD showcasing AI innovations, robotics advances, chip technologies, Micro RGB display advancements, and new gaming monitors.

This year’s event is expected to highlight practical AI applications in consumer products, from smart home devices to automotive technology, signaling AI’s transition from experimental to everyday technology.

The Tech Buzz team will be there to bring you coverage from Las Vegas.

Crypto Continues Its Takeover of Finance

Cryptocurrency had a huge 2025, not only setting new All Time Highs for market cap and key asset prices, but it was the year that Wall Street and Washington both finally came to the party. The lines between crypto and the legacy financial markets are being erased in real-time.

As a signal this trend is set to continue, Trump Media plans to issue digital tokens to shareholders via partnership with Crypto.com, with CEO Devin Nunes highlighting blockchain’s role in transparency and regulatory clarity. This move represents a test case for how traditional media companies might leverage blockchain technology for shareholder engagement and capital formation.

The WYDE $EAT Token Open Deal

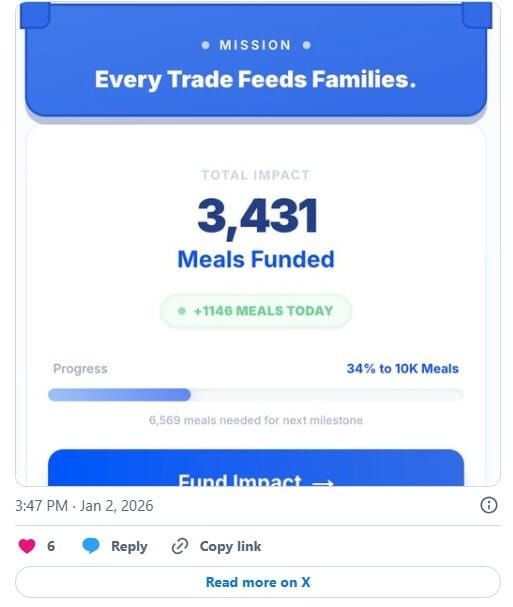

We have been shouting from the rooftops these past few weeks about Wyoming Decentralized Exchange (WYDE), marking it as one of the key innovators we see in the crypto and blockchain sector as well as in the wider charity and impact space.

Since we first covered WYDE pre-launch in December, its first Impact Token, $EAT (End Hunger) has gone on to hit over $10 Million market cap at its peak yesterday, while already funding over 3200 meals for registered charities helping to combat food insecurity in the US. Here they are pitching Brian Armstrong the concept, jump into the thread and help them to get his attention.

Regulatory & Policy Developments

Crypto policy will be on the agenda again this year. As will other areas like CHip exports and manufacturing.

TSMC Gets Green Light — The U.S. just approved TSMC to import American chipmaking equipment annually to its Nanjing facility, ensuring steady operations. The plant produces 16-nanometre chips and contributes 2.4% to TSMC’s revenue. This decision reflects the delicate balance policymakers are striking between national security concerns and maintaining functional semiconductor supply chains.

Key Takeaways For 2026

The tech industry enters 2026 with unprecedented momentum in AI adoption, infrastructure investment, and enterprise transformation, balanced against growing concerns about sustainability, regulation, and market consolidation. The coming year will likely determine whether AI delivers on its transformative promise with ROI for both users and companies providing the services changing our world.

Early trader sentiment should also give us a clearer picture as to where the financial markets stand, given the massive AI spend and fears of an AI bubble re-emerge as new financial data and market shifting announcements start dropping. At present it seems to be off to a strong start, however doubts about the sustainability of this market and the ever-evolving geopolitical situation do seem to be dampening some of the 2025 optimism. Dual-use defense and consumer AI tech may well be a resilient market regardless of war and peace, which means the tech (including physical AI) will continue so long as the resources to fund it are there.

A US Lithium Rush?

Speaking of resources… the US just discovered a “vast” Lithium Deposit that could cover nearly half the nation’s lithium demands. Almost two centuries after California’s gold rush, the US is on the brink of a lithium rush. As demand for the material skyrockets, government geologists are rushing to figure out where the precious element is hiding. This latest discovery lies in plain sight in wastewater from Pennsylvania’s gas fracking industry, making it a great circular economy innovation.