Health Update: Health Update: How Pari Passu Venture Partners Is Reshaping Health and Wellness Investing – What Experts Say– What Experts Say.

A closer look at how investors behind Function Health, Ammortal and Blueprint have created a model that gives accredited operators and executives access to selective early-stage investments.

Capital is moving steadily into fitness, wellness and health as the category continues to mature into a defined, investable market. For operators and founders within the industry, this growth is well understood. Less visible is the volume of early-stage investment activity now shaping where capital is being allocated.

Until recently, access to these early-stage investments was largely limited to institutional venture firms and closed networks with high minimum commitments. That structure is shifting.

Within this evolving landscape, Pari Passu Venture Partners (Pari Passu) has established a distinct position, reviewing a high volume of early-stage opportunities and investing selectively, while enabling a curated community of roughly 3,000 accredited individuals to participate on a deal-by-deal basis in opportunities that have historically been difficult to access.

That emphasis on curation and alignment resonates.

“For me, the biggest value is trust,” says physician and Parsley Health founder, Dr. Robin Berzin. “I like that I get to invest alongside people who really understand what makes a company stand out.”

At Pari Passu, this approach translates into a steady flow of inbound opportunities. “We review between 10 and 20 early-stage deals each week across diagnostics, longevity, consumer health and fitness-adjacent technology,” says Kyle Widrick, co-founder and general manager of Pari Passu. “Out of that flow, one or two deals typically move forward.”

That level of selectivity is deliberate. Pari Passu does not operate on a traditional fund cycle or pursue a volume-driven venture strategy. Instead, the firm invests opportunistically, leading and participating in each deal it brings to its community. The result is consistent, conviction-based deployment rather than capital allocation tied to fixed fund timelines.

For Widrick, investment decisions are guided by a clear framework.

“We look at three things,” he says. “First is the product and the founder’s vision — you have to believe in the person behind what’s being built. Second is execution: can the company actually scale? And third, which is increasingly important in today’s consumer market, is distribution and awareness. Even strong products need a clear path to reach people.”

Building for Scale in Consumer Health

While Pari Passu invests across multiple sectors, health, wellness and fitness remain central to its focus. From Widrick’s perspective, the opportunity is less about novelty and more about alignment with long-term consumer demand.

“Consumer demand is clearly shifting toward proactive health, performance and longevity, and the companies being built to meet that demand are more sophisticated, more data-driven and more operationally sound than in previous cycles,” he explains.

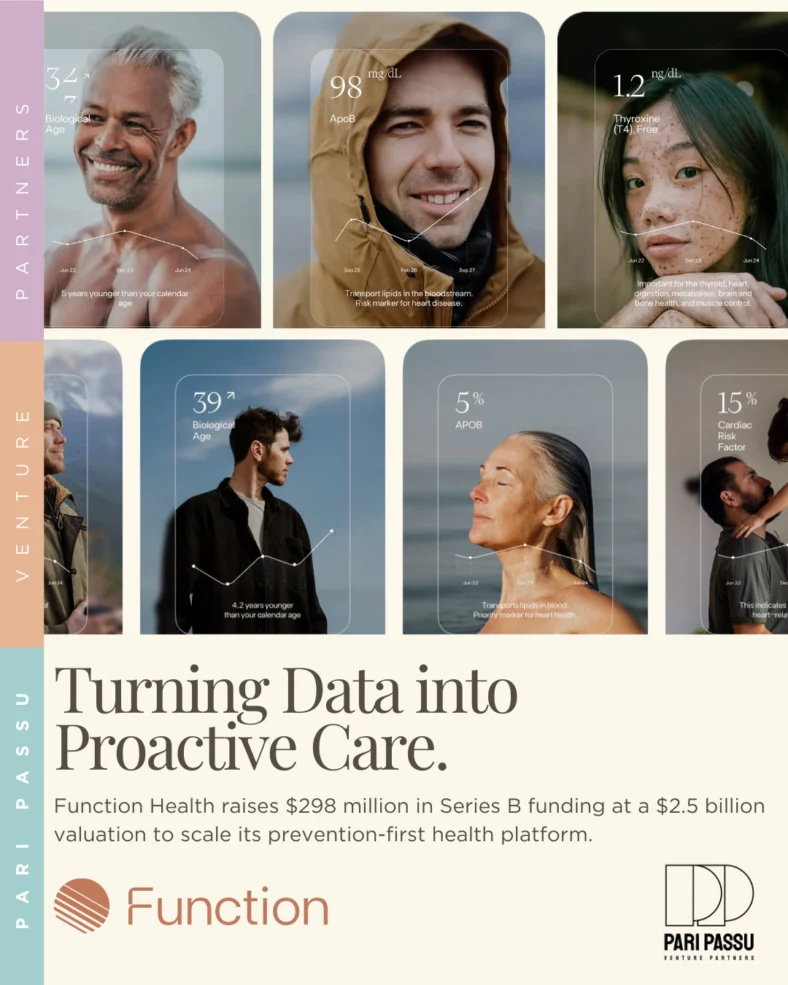

Recent investments reflect this focus. Pari Passu was an early investor in Function Health, a platform designed to broaden access to comprehensive diagnostics and health data. It has also backed companies such as Ammortal, which sits at the intersection of hardware, technology and performance, and Blueprint, the health and longevity platform built around Bryan Johnson’s highly visible, consumer-led approach.

The firm’s portfolio also includes brands such as Coconut Cult, a probiotic yogurt company, and Cove Soda, reflecting Pari Passu’s interest in functional food and beverage brands aligned with broader health and wellness trends.

Across categories — from diagnostics and supplements to devices and functional consumer products — a consistent theme emerges: enabling individuals to take a more proactive role in their health, earlier and with greater precision.

A Different Model for Access

What differentiates Pari Passu is not only where it invests, but how.

Rather than requiring investors to commit large sums to a blind-pool fund, Pari Passu operates a deal-by-deal co-investment model. Members of the Pari Passu community evaluate each opportunity individually and choose whether to participate alongside the firm.

Minimum investments typically start around $10,000, which is a meaningful commitment, but significantly lower than the $250,000 to $1 million minimums common in traditional venture funds.

“For many people, private investing has felt out of reach,” Widrick says. “This model allows accredited individuals to participate selectively, based on their own interests and conviction.”

Access is intentionally curated. There is no fee to join the community, but participation is referral-based and vetted. The emphasis is on alignment — bringing together operators, founders, executives and experienced investors who understand the realities of building businesses, particularly in complex, people-driven sectors like health and fitness.

“This structure creates a community that extends beyond capital,” Widrick adds. “Members are often able to contribute operational insight, domain expertise or strategic support to the companies we back.”

That dynamic is echoed by operators investing through the platform.

“I get access to investment opportunities I don’t see every day, and can invest alongside the Pari Passu team and community members who, like myself, are operators. It’s curated, personal and community-driven,” Berzin adds.

For founders building in the space, the model also offers early visibility into companies they’re also passionate about.

“As a founder myself, I love seeing the best and hardest to access deals well before anyone else does,” says Dean Kelly, co-CEO of Extension Health. “Some of these companies raising money at huge valuations in the health and wellness space are brands that I’ve been using from day 1 — and now being actually able to be a part of the journey and hopefully share in that financial upside as well is pretty special.”

Kelly also points to flexibility as a differentiator.

“You don’t need to write huge checks as you do in traditional venture capital, which allows you to spread your investments and be selective about where you participate,” he says. “And the fact that these opportunities are on the Pari Passu platform means they’ve already been vetted by people much smarter than myself, which gives me confidence that I’m seeing only the strongest deals.”

Despite the momentum in health and wellness investing, Widrick is clear about the realities of early-stage venture capital.

“This isn’t for everyone,” he says. “It’s early-stage investing, and that comes with risk.”

Pari Passu does not subscribe to a “spray and pray” approach. Each deal the firm advances is evaluated with the expectation that it can deliver meaningful returns — often targeting a 10x outcome — while recognizing that not every investment will succeed.

“When people think about investing, the focus is usually on public equities, real estate and cash equivalents,” Widrick says. “Early-stage investing is a different vertical altogether. It’s higher risk, but with the potential for outsized returns.”

For those drawn to the space, the appeal extends beyond financial upside. It’s the opportunity to invest in sectors they understand, alongside people they trust, at a stage where engagement and insight still matter.

As access to private markets continues to evolve, Widrick expects more platforms to emerge offering different paths into early-stage investing. Larger consumer platforms may open access to later-stage private companies, but he believes early participation — particularly in health, wellness and fitness — will continue to be driven by smaller, curated networks.

For Pari Passu, that reinforces its focus.

“The space is moving quickly,” Widrick says. “The market shows no sign of slowing, particularly as scale and long-term significance continue to increase.”To learn more about Pari Passu, upcoming health and wellness venture deals and how to apply to join the investment community, visit www.ppvp.com/atnpro.